The EU officially passed the Corporate Sustainability Due Diligence Directive, or the CSDDD, during its April plenary session. The directive, which forms part of the bloc’s green strategy, has gone through several years of negotiations between MEPs and industry leaders before reaching its final form. Now, with the scope of the CSDDD significantly lessened, the EU’s largest companies will have two years to prepare for the responsibility of supporting their value networks in adopting and maintaining sustainable practices.

With the updates to the CSDDD scope, EU was keen to target only the companies that had enough resources to proactively maintain compliance with this regulation. Therefore, though small and medium-sized businesses may be impacted through the influence of larger companies, SMEs themselves will not be subject to undue regulatory burden. Here is the summary of the latest EU CSDDD scope.

CSDDD scope is based on revenue and size

The scope of the CSDDD was drastically reduced during closed door sessions during early 2024. While the EU initially pushed for companies with over 500 employees and €150 million net turnover to be included, there weren’t enough votes to pass the directive. Instead, the EU passed a highly focused piece of legislation in March 2024, limiting the businesses within scope to only the largest and most influential companies.

Therefore, the companies that will fall into the CSDDD’s scope are:

- EU companies with over 1000 employees and a net turnover of more than €450 million worldwide

- Parent companies with over 1000 employees and a net turnover of more than €450 million

- Non-EU (third country) companies with over 1000 employees and a net turnover of more than €450 million

- Franchises with a net turnover of over €80 million, if at least €22.5 million of that turnover was generated through royalties

If a company meets one of these criteria in the past two financial years, they will be under the scope of the CSDDD. If the criteria ceases to be true for a period of two financial years, the requirements of the CSDDD will no longer apply.

Why the EU updated the CSDDD scope

The CSDDD allows the EU to test out a key hypothesis: that companies, when incentivized to support their value networks’ ESG goals, will create a more sustainable business landscape overall. As a result, the narrowing of the CSDDD’s scope doesn’t necessarily mean that SMEs or businesses that are just below the threshold for inclusion won’t be impacted by the new directive, though they won’t be directly beholden to these new requirements. As the CSDDD requires in-scope companies to provide direct or indirect support to suppliers with sustainability risks, the EU is hoping that the level of sustainability rises throughout global value networks.

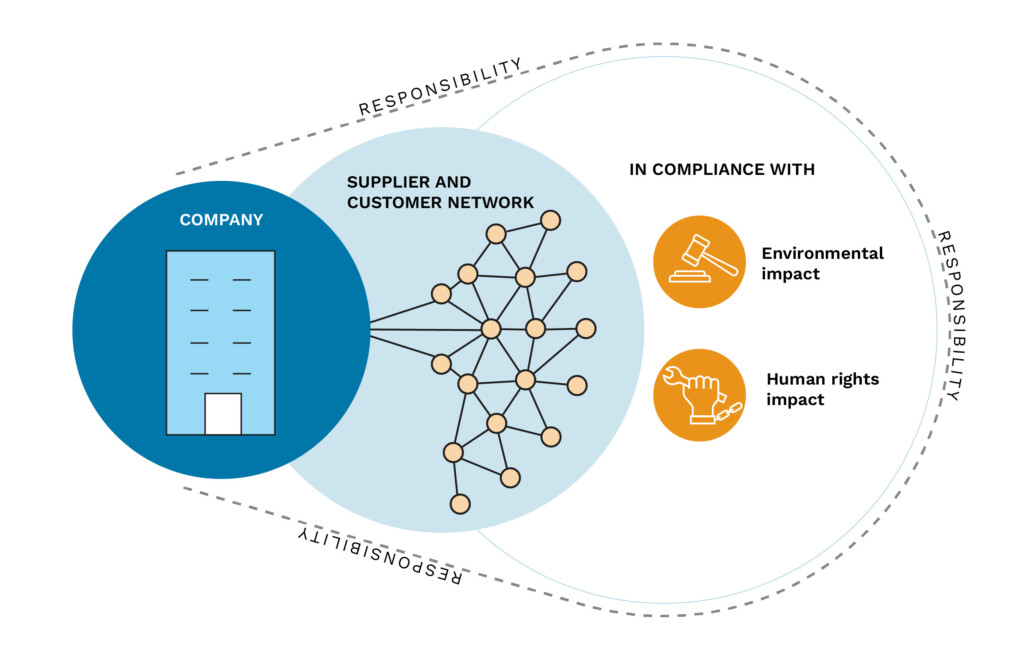

Figure 1: The EU CSDDD scope applies to the entire value network, from subtier suppliers to end users.

Figure 1: The EU CSDDD scope applies to the entire value network, from subtier suppliers to end users.

This directive will be harder to ignore than other legislations, where non-compliance fines can be factored into the cost of doing business. Companies must take appropriate supportive action to help their suppliers meet internal sustainability goals instead of cutting ties immediately with non-sustainable third parties. These sustainability goals must be in line with the Paris Agreement and clearly stated within supplier contracts. And, all of these goals, actions, and other details must be reported annually, so the EU and consumers alike can keep corporations accountable.

CSDDD scope for financial and high-impact sectors

Financial firms fall within the CSDDD’s scope with specific considerations. The CSDDD’s focus for financial firms is primarily on upstream activities – that is, on the direct and indirect suppliers that businesses use to run their operations. Therefore, financial firms are exempt from reporting or acting on their investment or lending activities within the context of the CSDDD.

This was a controversial decision, as the majority of carbon emissions stem from downstream financial undertakings. While pushback from MEPs may have won this round, the CSDDD could be amended to instruct financial firms to meet the full requirements of the directive in the future.

Similarly, companies within high-impact sectors were also originally subject to lower scope requirements, meaning that a greater percentage would have been accountable to the CSDDD. High-impact sectors are those that have significant carbon footprints and high risk for labor abuses, including textiles, agriculture, mineral resources, and more. However, this provision also received significant pushback, leading to the EU dropping it in favor of passing the bulk of the CSDDD. Again, provisions have been included that will allow the EU to revisit the scope for high-impact sectors in the future, if needed.

Phasing in the CSDDD’s scope

The EU officially passed the CSDDD on 24th April 2024, starting the multi-year process of putting it into effect. Now, EU Member States will have two years to port and pass the directive into their respective national legislations. Then, the directive will be implemented in phases, starting with the largest companies in 2027, before going into full force in 2029.

The timeline will look like this:

2024 – 2026: EU Member States introduce and pass the CSDDD within their respective legislations

2027: The CSDDD will go into effect for companies with 5000+ employees and a net turnover of €1500 million

2028: The CSDDD will go into effect for companies with 3000+ employees and a net turnover of €900 million

2029: The CSDDD will go into full effect for all eligible companies

Companies will have up to five years to prepare for CSDDD enforcement, which isn’t a long time considering the breadth of organizational changes that will need to happen to start complying satisfactorily. And even companies out of scope should be preparing for the CSDDD, as it will undoubtedly change relationships and expectations with large companies or suppliers.

Figure 2: Companies in scope have extensive compliance responsibilities for their value networks.

Figure 2: Companies in scope have extensive compliance responsibilities for their value networks.

Though the focus of the directive may not be immediate fines, non-compliance will be punished by up to 5% of a business’ worldwide net turnover. Starting your CSDDD preparations now can ensure that your company is as prepared as possible ahead of enforcement. Plus, the CSDDD is not the first green legislation to be passed in the past five years, nor will it be the last. With the increased worldwide emphasis on green campaigns from governments and consumers alike, you’ll probably be well-prepared for any new sustainability consideration that comes your way.