Cross-border trade along the U.S.-Mexico border faces risks due to the upcoming Mexican elections in June and the U.S. presidential elections in November. Mexico recently replaced China as the top exporter to the U.S. with nearly $475.6 billion (€438 billion) of goods exported while cross-border trade between the two countries rose to $798 billion (€735 billion) on the back of near-shoring efforts by companies that are relocating manufacturing operations away from China.

Likewise, mining and the commodities it produces face disruption after Mexico’s election. With widespread environmental concerns and protests in Mexico, both the existing administration and the likely election winner are set to further limit domestic mining operations.

Mexico migration disrupts supply chain trade

Rail-related trade disruptions along the border have already been increasing due to the ongoing influx of migrants into the U.S. The disruptions caused by the migrant crisis could lead to greater anti-immigrant sentiments and ultimately lead to policies that could stifle cross border trade.

LEARN MORE ABOUT GLOBAL ELECTION RISKS IN 2024: GET THE REPORT

Republican candidate Donald Trump previously threatened to completely shut down the border to force Mexico to stem migrant numbers. A re-elected President Trump could also use an upcoming review of the United States-Mexico-Canada Agreement (USMCA) that is scheduled for July 2026 to press Mexico into adopting tougher border policies. The review process will determine whether the free trade agreement will be extended beyond its current end date of June 30, 2026, and a Trump-led U.S. administration could threaten to delay plans for the USMCA’s approval over border issues.

President Biden’s attempts to restrict migrant flows have also been blocked by Republicans in the U.S. Senate, adding to fears that domestic politics will continue to hinder U.S. ability to rein in migrant flows until the upcoming presidential elections. The U.S.-Mexico border will therefore likely remain vulnerable to disruptions in the event of a spike in migrant flows this year.

Mexican attitudes towards the migrant crisis are unlikely to be affected by the country’s upcoming presidential elections. The current front runner, Claudia Sheinbaum, is widely expected to continue the current administration’s policy of viewing the crisis as a socio-economic problem to be addressed in migrant countries rather than a pressing security issue. Migrant related disruptions along the U.S.-Mexico border are therefore likely to continue and diplomatic relations with the U.S. could be strained if the crisis persists.

Environmental concerns threaten Mexico mine development

Ahead of the 2024 elections in Mexico and the United States, an increased demand for metal commodities, especially those important in electric vehicle production, have led to a debate between mining industry advocates and environmentally conscious lawmakers.

LEARN MORE ABOUT GLOBAL ELECTION RISKS IN 2024: GET THE REPORT

Current Mexican President Andrés Manuel López Obrador has criticized foreign mining companies throughout his tenure and implemented policies limiting their expansion, including a halt on the issuing of new mining licenses and the nationalization of lithium deposits. His chosen successor, MORENA candidate Claudia Sheinbaum, was a key proponent for the latter policy and has adopted much of his mining policy platform.

In February 2024, López Obrador proposed a ban on open-pit mining, a practice that environmental advocates allege overuses land and water resources and pollutes the surrounding environment. Sheinbaum has confirmed that she hopes to push the measure through once in office.

The future of Mexico’s mining supply chain

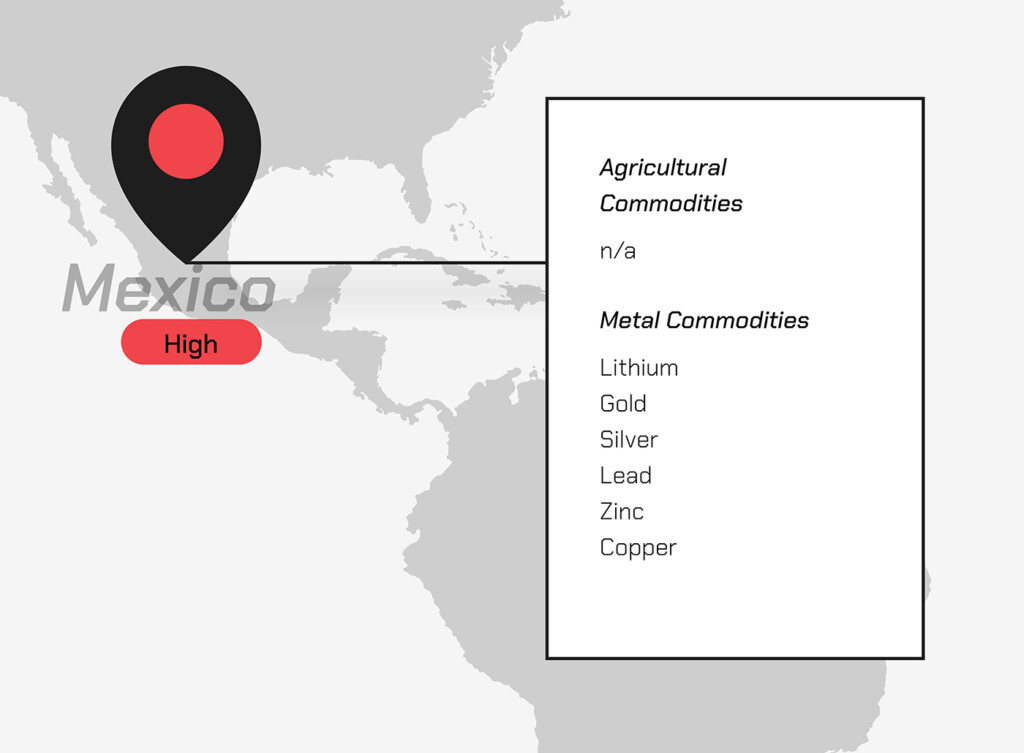

Figure 1: Mexico is a valuable source of metal commodities to the global supply chain.

Figure 1: Mexico is a valuable source of metal commodities to the global supply chain.

If Sheinbaum is elected with strong legislative support, manufacturers should anticipate both the continued limitation of foreign mining developments in Mexico, and the potential of an open-pit mining ban to affect Mexican metal production. Mexico is the world’s largest producer of silver and a top-ten global producer of lead, zinc, gold, and copper; these commodities are among those currently produced using open-pit methods.

Affected open-pit mines could include Grupo Mexico’s Buenavista del Cobre copper mine, Newmont Gold Corporation’s polymetallic Peñasquito mine, two of Fresnillo plc’s gold-silver mines, and several mines owned by Industrias Peñoles S.A. de C.V. Any temporary or permanent disruptions to these mines’ operations could have severe impacts on the global market.

Alternates to Mexico supply chain commodities

In the U.S., both major political parties have expressed support for strengthening supply chains for commodities related to electric vehicle production including lithium, copper, and nickel. The Republican Party’s recent proposals support developing these materials through development of mines on existing deposits within the U.S., with propositions that include halving the time period for approving mine permits and limiting the amount of time under which lawsuits against existing mines can be filed.

The Biden administration has expressed concerns about the environmental impacts of these measures, and has moved instead to expand tax credits to mineral suppliers in countries that have existing free trade agreements with the U.S. including Chile, Australia, and Canada. Republican measures to overhaul the mine development process in the U.S. would likely be contingent on winning both legislative and presidential elections.

LEARN MORE ABOUT GLOBAL ELECTION RISKS IN 2024: GET THE REPORT