Your company probably has a risk manager, but “risk” in a business context has such negative connotations. Managing risk has inherently been a defensive activity, as in “Let’s react to this scary event as best we can.” Instead, for companies ready to lean into risk visibility, the next scary event your industry faces can reveal opportunities that create market advantages.

Let’s start by hiring Opportunity Managers instead of Risk Managers. Here’s how this new role can create value for companies that think of risk as an opportunity instead of something to fear.

A good time to be hungry for risk

Large organizations tend to view risk as something to be avoided at all costs, a perspective that has been reinforced by risk-averse corporate governance standards around the world. By contrast, startup companies are dependent on some level of uncertainty, which helps them disrupt and grow in their target markets.

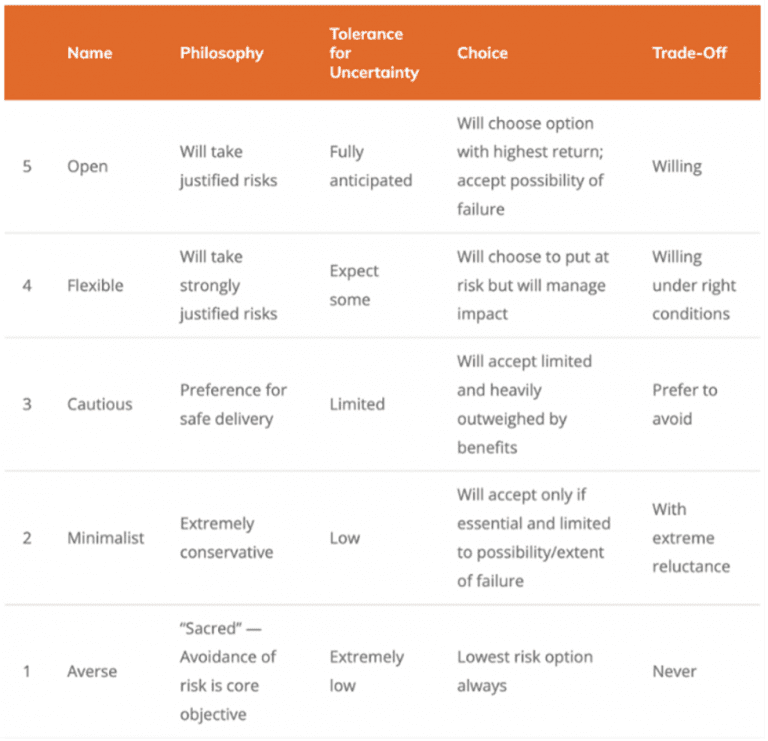

Table 1: Risk matrix; Source: “Risk Appetite: Know How Hungry Your Company Is for Risk,” Riskonnect, cited Feb. 2022.

That’s why determining an organization’s risk appetite—or the amount of risk an organization is willing to undergo in order to capture opportunities—is central to opportunity management.

Some companies, such as SMB Offshore, are miles ahead of everyone else in this regard. SMB Offshore has incorporated risk appetite evaluations into its reporting since 2016, explaining its risk appetite stance and associated opportunities generally, by country, and by issue.

A company’s level of risk appetite is typically deeply embedded in its culture and can be difficult to modernize. But, as businesses become increasingly interconnected, unpredictable events will regularly interrupt supply chains. By deliberately updating their organization’s risk appetite, Opportunity Managers can steer their team towards opportunity capture or event recovery.

Technology feeds risk visibility

Transparent and continuous risk analysis is also key to opportunity strategy. To this end, Opportunity Managers should also continuously invest in digitalization and emerging analytics. By understanding risks within their supply chain, Opportunity Managers can take advantage of global events.

Toyota and Tesla are two examples of companies that benefited from recognizing and subsequently leaning into potential risks. Toyota’s recent rise to the top of the leaderboard in the U.S. can be attributed to its decision to stockpile computer chips—a seemingly unnecessary expense at first glance. But, Toyota certainly had the last laugh as other companies suffered during the global chip shortage. Tesla took a more radical approach by striving for autonomy, adapting its software to work with any chips they could get its hands on.

Companies that are aware of these kinds of crunch points are also more likely to be able to bounce back quickly from disruptions. For example, a fire at the Royal Philips Electronics radio frequency chip manufacturing plant in early 2000 affected two companies, with opposite results. Nokia acted quickly and was able to boost its profits and strengthen its market share. Ericsson, on the other hand, suffered an operational loss in the millions, and its market share shrunk significantly.

Supply chain risk analytics can currently be applied across segments, including sales and operation planning, sourcing, production, and more. Distinguishing the different risk profiles of each segment helps in identifying specific benefits or in warding off potential crises. And, as risk technologies continue to develop, Opportunity Managers will have an improved view into risks across the supply chain.

The sweet finish

Opportunity Managers will get their cake and eat it, too: controlling their company’s supply chain risk posture to prevent disasters while taking advantage of otherwise inaccessible ventures.

Companies that are willing to test emerging technologies seasoned with a healthy amount of uncertainty will be rewarded for their boldness. Using risk analytics, Opportunity Managers can lead companies into previously unseen opportunities.