Once raw materials are sourced, medical devices are manufactured and assembled. This is also often an international process, with different manufacturing locations around the world. However, if tariffs affect the price of imported components, production becomes less cost-effective and harder to maintain. Some medical device companies may start looking to move their operations closer to their primary markets; however, this transition requires a significant investment in time, infrastructure, and regulatory approvals.

Companies may also face challenges in maintaining regulatory compliance in the face of tariffs. For example, if manufacturers switch suppliers due to tariffs, they may need to requalify materials and components in order to meet FDA, ISO, and other necessary requirements.

Finally, medical devices must be ultimately transported across borders to their final destinations, adding another layer of consideration when it comes to tariffs. Increased shipping costs, customs duties, and trade restrictions make it challenging to maintain efficient global distribution networks.

Today’s tariff landscape

Since the medical device industry is so inherently global, companies and manufacturers often face a difficult decision: to absorb the extra expenses, or to pass them on to healthcare providers and patients. This is on top of the decisions they already must make to keep their supply chain operations smooth and efficient in the face of tariffs.

Today, one of the most significant trade disruptions affecting the medical device sector stems from the US-China trade war, increasing costs for US manufacturers relying on Chinese suppliers. Increases on tariffs on Chinese imports under Section 301 of the Trade Act have impacted a wide range of medical devices and medical device components, including syringes and needles, respirators, and electronic parts essential to diagnostic and monitoring devices. Under an executive order, an additional 10% tariff was imposed on all Chinese goods from February 1 with this rate increased to 20% from March 4, placing further strain on manufacturers reliant on goods from China.

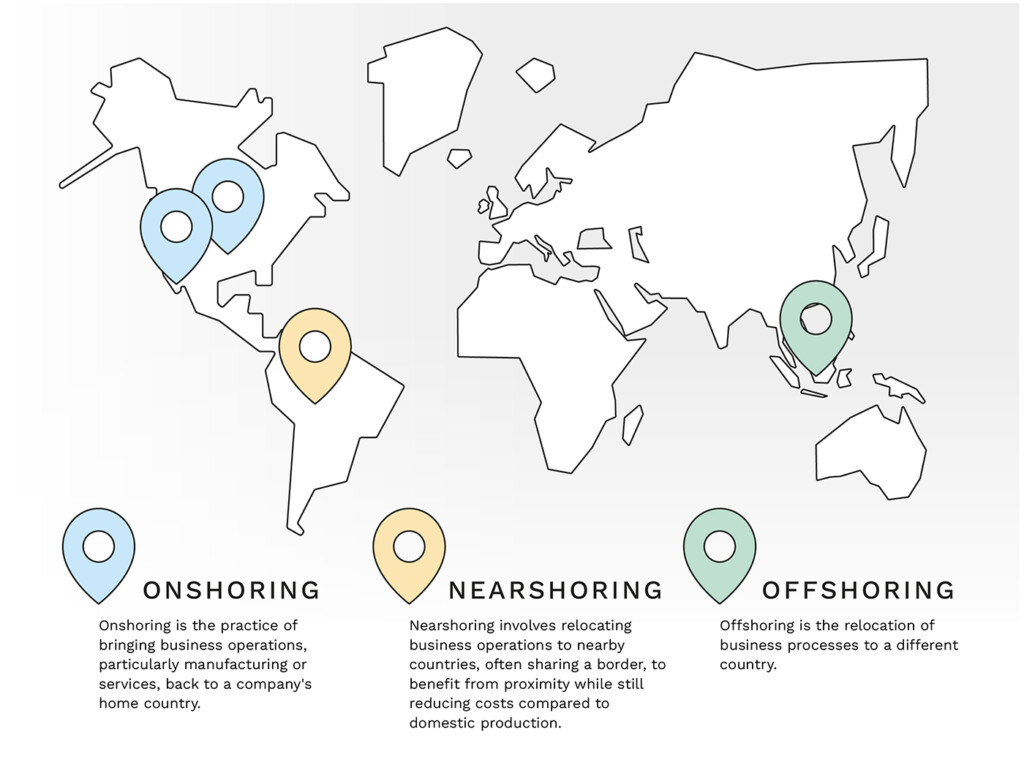

Figure 1: U.S. Tariff Rate on Chinese Imports: 20% Effective March 4, 2025

Figure 1: U.S. Tariff Rate on Chinese Imports: 20% Effective March 4, 2025

The US has also extended tariffs on imports from Canada and Mexico under the International Emergency Economic Powers Act (IEEPA). While these tariffs have been temporarily paused for items compliant with the USMCA free trade agreement, they threaten to provoke a trade war on the continent with Canada already implementing a first set of retaliatory tariffs. Disruptions to trade with Mexico could prove particularly impactful to medical device manufacturers, many of whom have established operations in the country.

In other parts of the world, the EU and other countries have implemented tariffs and strict regulatory policies on medical device imports and exports. For example, Brexit introduced new trade barriers between the UK and EU, creating customs delays and an increase in compliance requirements.

Ultimately, continued negotiations for tariff relief or new trade agreements continues to create uncertainty in the medical device space, leaving companies struggling to plan long-term strategies.

Creating an impactful long-term strategy

It seems the only certainty in the changing geopolitical tariff landscape is that there will be change. Therefore, to minimize the impact of tariffs on their supply chains, medical device companies must adopt proactive strategies to maintain cost efficiency and operational stability.

To begin, supplier diversification is a critical first step. Reducing dependency on any single country affected by tariffs is one of the most impactful actions you can take to maintain smooth operations, and can go a long way to protecting your company in the face of quickly changing geopolitical decisions.

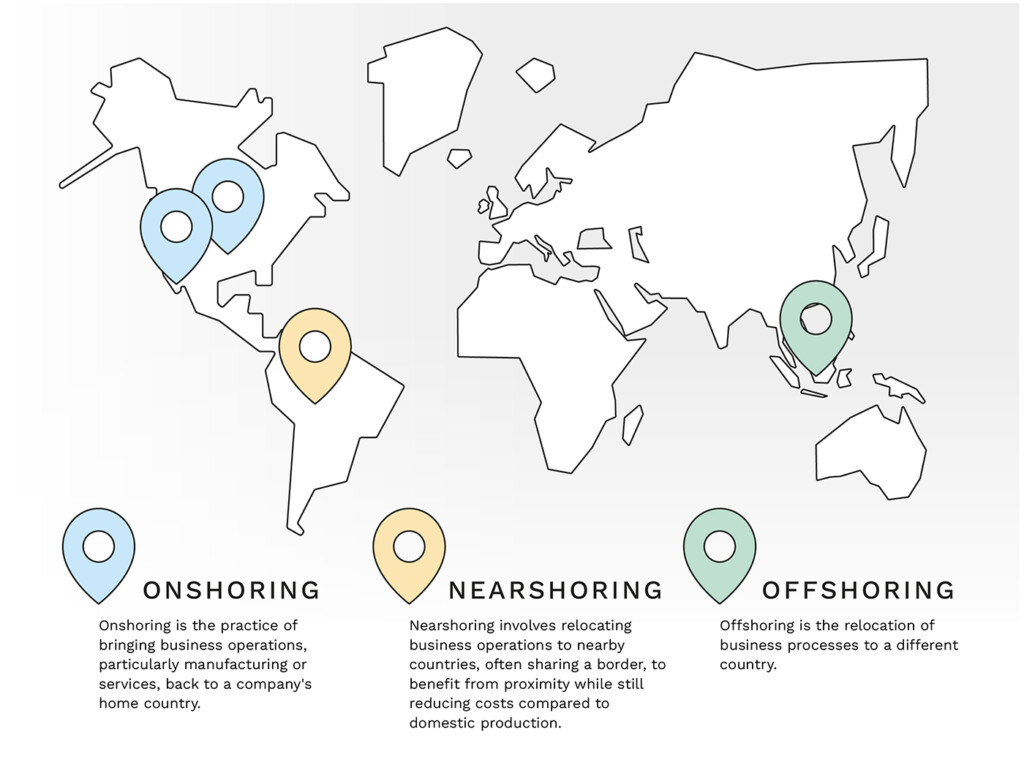

Then, if possible, companies may consider nearshoring or onshoring their operations and manufacturing as much as possible. This strategy may include shifting production to regions with fewer trade restrictions and long-term positive relationships with the end market, to reduce tariff exposure.

Figure 2: Understanding global sourcing: Nearshoring, Onshoring, and Offshoring

Figure 2: Understanding global sourcing: Nearshoring, Onshoring, and Offshoring

Next steps

Creating a long-term strategy doesn’t happen overnight. Here are the first few steps you should take to start your journey toward supply chain reliability in the face of changing geopolitics and tariff risks.

Understand your supply chain. Where are your areas of over-dependency? Whether it’s on one supplier, one country, or one region, you need to understand where your tariff risk exposure is, especially when it comes to critical materials or components. Keep in mind that this dependency may not be evident from your Tier-1 suppliers, but could be buried in your sub-tier suppliers.

Monitor for tariff changes. Using tools like Everstream Reveal can alert you to potential tariff changes and model possible outcomes, allowing you to make proactive decisions. With advanced analytics and a wealth of data from public and private streams, these tools provide you with actionable intelligence, allowing your supply chain management team to make critical decisions at the right time.

Always have a plan B. Stay proactive, and always have an eye on a variety of suppliers. For example, Everstream can help you find alternative suppliers in real-time, allowing you to keep your operations efficient and effective in the face of rapid changes.

The medical device industry’s reliance on complex global supply chains makes it especially vulnerable to tariffs and shifting trade policies. By adopting proactive strategies, such as supplier diversification, nearshoring, and real-time tariff and supply chain monitoring, companies can safeguard their supply chains, ensuring critical medical technologies remain accessible and affordable to healthcare providers and patients worldwide.

Figure 2: Understanding global sourcing: Nearshoring, Onshoring, and Offshoring

Figure 2: Understanding global sourcing: Nearshoring, Onshoring, and Offshoring