After July 2022, almost all government-run financial COVID-19 support programs in Europe ended, fueling concerns by supply chain managers about a potential rise in financial troubles among their supplier bases. Coupled with record high energy costs in Europe that have already forced energy-intensive manufacturers to reduce or stop factory activity, financial distress at a supplier level has significantly increased in recent months.

Many supply chain analysts expected that general corporate insolvency filings would start to return to normal levels in the third and fourth quarters of 2022. But despite mounting financial pressures, our research shows the overall number of European insolvencies declining since the start of the pandemic. Why the decrease in insolvencies at a time when financial pressures are increasing?

This disconnect can be largely attributed to new financial support programs for companies and their workforces.

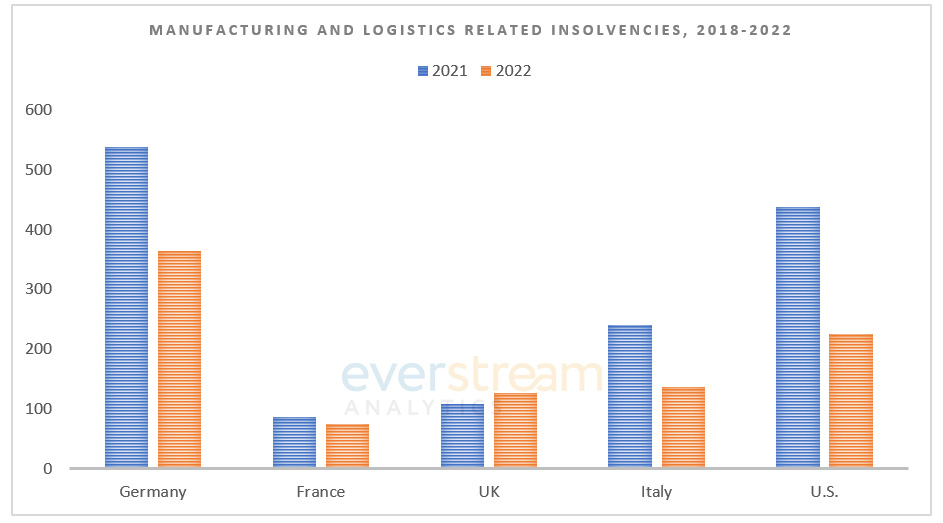

Figure 1: France’s insolvency numbers eclipse those from 2021 while 2022 insolvencies in Germany and the U.S. outpace those in other countries.

Due to increasingly high energy costs, several European countries recently created new financial support programs for energy-intensive industries that have seen energy costs double or triple compared to 2021. Germany and France, for example, have set up support programs for their most energy-consuming companies in recent weeks, while the UK is considering plans to subsidize power bills for energy-intensive industries such as steel and cement.

Most insolvency filings in 2022 come from key sectors including retail, construction, and hospitality. Everstream Analytics’ insolvency data focuses on manufacturing and logistics suppliers, which paints a different picture of the overall situation.

Our analysis of five of the world’s largest economies by GDP revealed that manufacturing- and logistics-related insolvency filings are tracking at lower levels for the entire year of 2022 in Germany, Italy, and the U.S., while insolvency filings in France could slightly increase. Only the filings in the UK have already surpassed 2021 levels, standing 16% higher, even before the end of Q3.

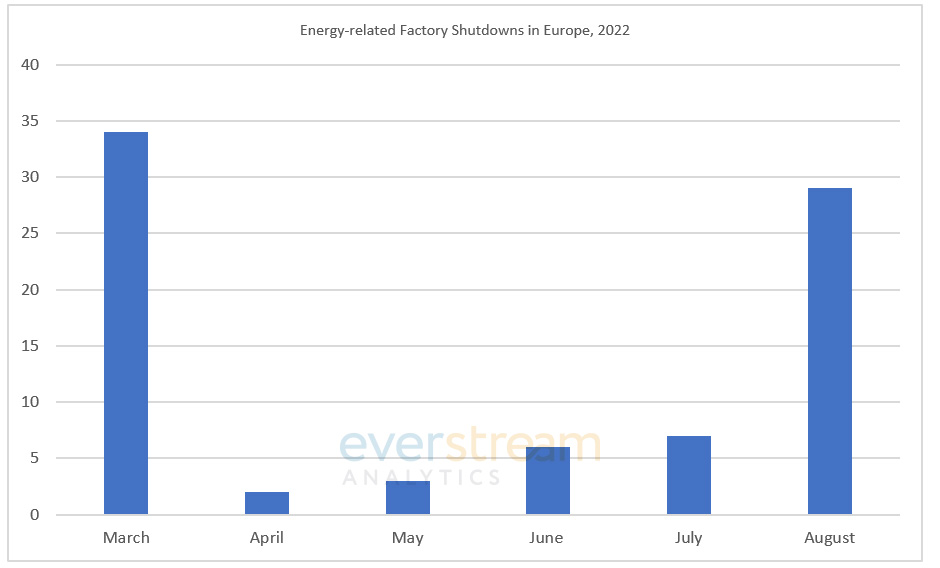

Figure 2: Increasing factory shutdowns in Europe reflect the impact of higher energy costs.

Higher insolvency numbers in the UK are likely due to suppliers facing higher energy bills, higher interest rates and falling order books, with authorities not yet adopting any financial relief measures compared to other countries in Europe. Energy bills in the UK are expected to increase by 300-400% in October when many fixed-price agreements will be re-negotiated.

Across Europe, dozens of energy-intensive companies in the glass, cement, ceramics, steelmaking, and petrochemicals sectors have responded to the energy crisis by reducing manufacturing operations. The number of factory shutdowns in Europe for August 2022 currently stands at the highest level year-to-date, only topped by energy-related stoppages after a March spike in energy costs following the Russian invasion of Ukraine.

Governments across Europe will likely set up new support programs to reduce the financial burden of higher energy costs. But, as highlighted by rising insolvency filings in the UK, start-and-stop programs triggered by fluctuating energy prices, administrative hurdles, and slow payouts could potentially come too late for some companies.

Get more details on Europe’s insolvencies in our webinar. Watch now.