The chemicals industry may be stable, but its risks are increasingly volatile. Multi-stage shipping routes for hazardous or delicate materials incur risk every step of the journey. Weather or political disruptions can shut down access to regional suppliers of critical materials or compounds. Shifting to just-in-time inventories, with more frequent, smaller shipments, is a catalyst for both procurement and logistics problems.

Now, high-tech risk analysis tools are helping chemical companies stabilize risk.

It’s now possible to digitally map an entire supply network, including supplier, production, distribution, and customer sites, with constant status updates on material moving via ports, airports, roads, or rail. Predictive analytics using artificial intelligence allow companies to visualize and rate multiple risk types before they materialize, estimate the potential damage costs, and solidify alternate plans before problems explode.

Track chemical supply chain transportation

As your precious cargo moves from warehouse to truck to ship to rail, details matter. Small issues like a stretch of road developing icy conditions, or the last mile of a planned route being flooded by arrival time – these are becoming more common as climate change creates extreme weather patterns. Even major sporting events can reroute or even shut down shipping routes for high-risk materials. Each issue can delay or destroy planned ETAs.

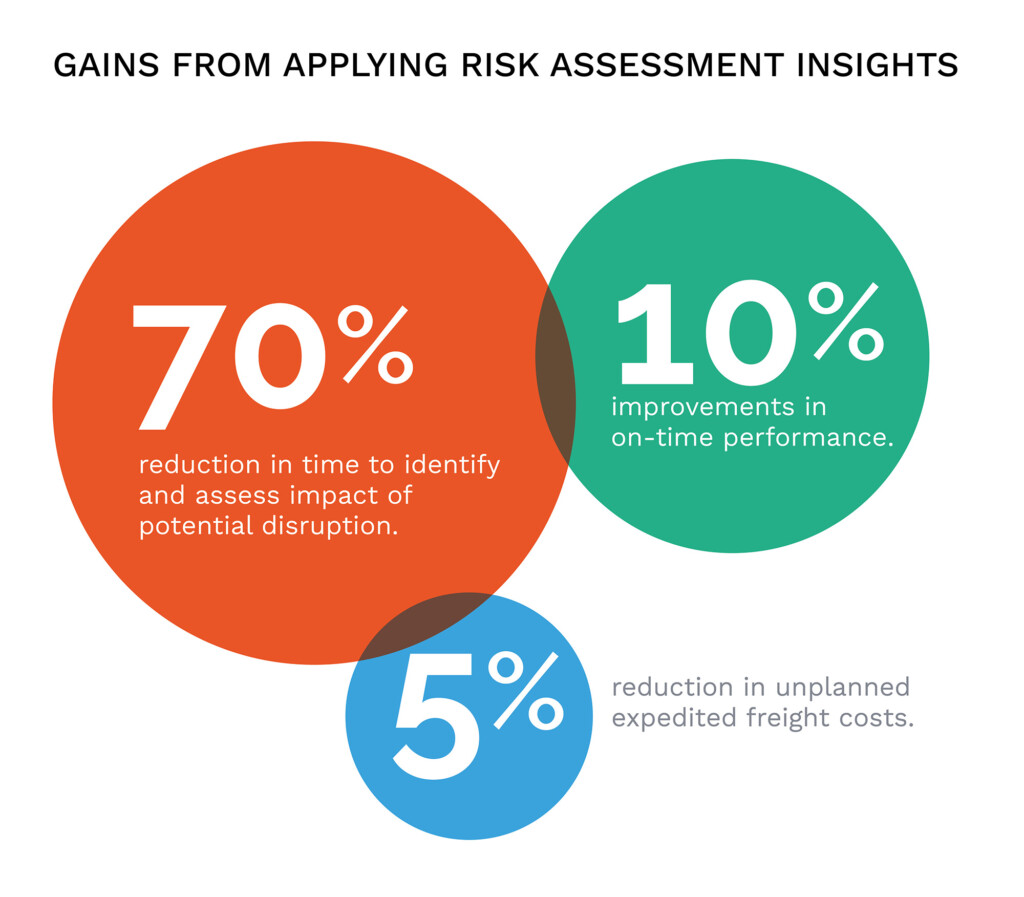

Figure 1: Chemical industry supply chain risk management can create significant savings in time, money, and other resources (source: Everstream Analytics).

Risk assessment platforms go beyond simple location monitoring to show weather forecasts for an entire shipping route so you know in advance if deliveries will be delayed.

Artificial intelligence also incorporates expert insights about other potential route disruptions including strikes, political unrest, border shutdowns, and more. AI can then generate detailed heat maps for different transportation lanes or even regions, highlighting segments that present the greatest risk.

CLICK HERE TO DOWNLOAD THE FULL PDF

Early warning can guide a company to declare force majeure, for example, and avoid late delivery penalties. With increased ETA accuracy, companies can save significant time and money overall by avoiding unplanned freight costs.

Forecast chemical supply chain catastrophes

Some of the most significant vulnerabilities in chemicals company supply chains lie outside their direct control. Raw materials or critical compound are often grouped in specific geographic areas to stay close to raw materials or processing expertise, which makes those materials at risk for regional disturbances. These suppliers are also in high demand because they work with many different manufacturers in varied industries.

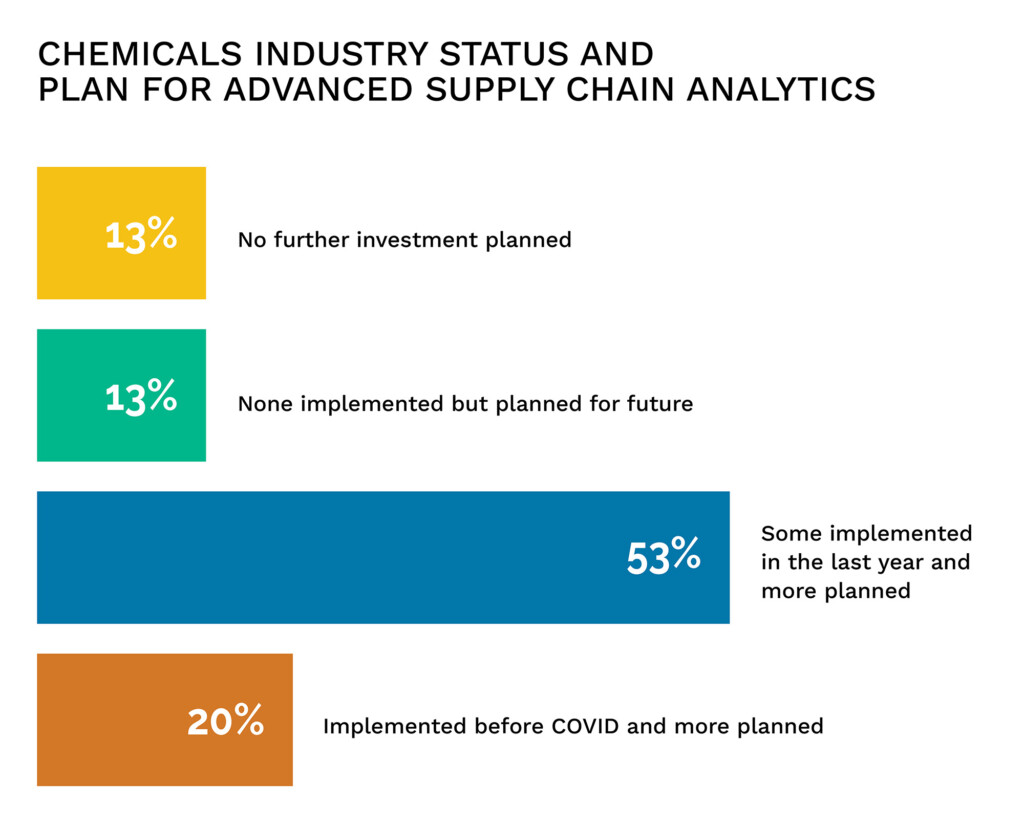

Figure 2: Chemical supply chain leaders are investing in risk management platforms. (source: McKinsey survey of global supply chain leaders, 2021).

While a chemical company can usually weather small supply chain disruptions here and there, these geographic clusters are at high risk for area-wide problems that can upset critical supplies.

For example, hurricanes or unexpected freezes in the American Gulf Coast have shut down area oil fields and refineries, and customers in multiple industries compete for supplies as soon as production resumes. Another example is the war in Ukraine, which blocked a high percentage of the world’s fertilizer and related product exports.

With risk analysis platforms, alerts can be customized to monitor specific regions, facilities, or materials. Those alerts can be integrated into a company’s existing supplier relationship management system. Every minute counts when preparing for incoming hurricanes, flooding, power grid outages, political upheaval, force majeure, scheduled and unscheduled maintenance, and other extreme disruptions. Early alerts buy companies time to leap ahead of their competition by securing alternate sources before price hikes.

Stay ahead of chemical supply chain compliance

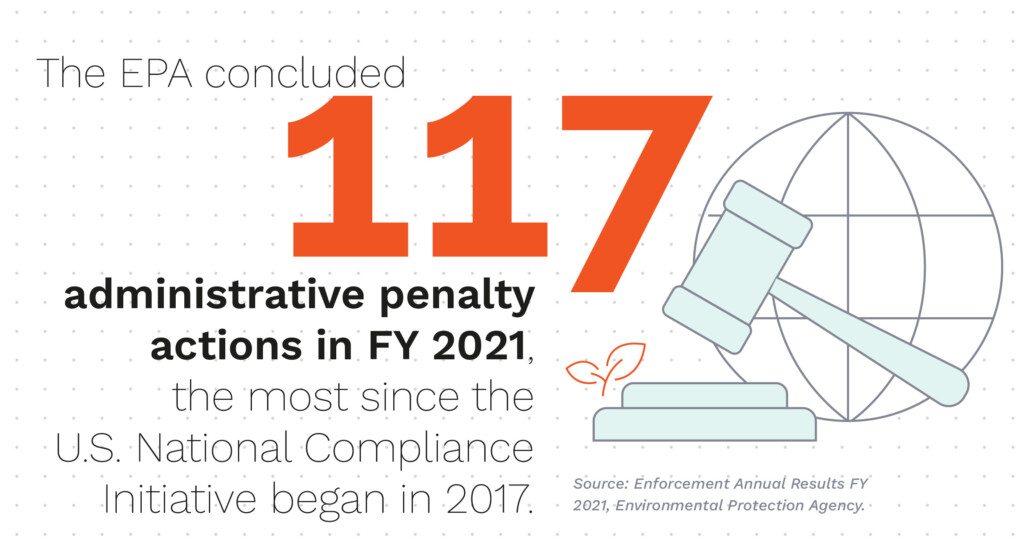

Compliance officers know full well the regulations that apply to their operations. But technology offers line of sight to emerging regulations. Risk management platforms can alert compliance or safety officers immediately about fires, explosions, spills, and other safety risks at key supplier facilities or regions. Also, alerts can be set for environmental problems at those locations including emissions violations, air pollution, dumping, and more.

These events often trigger enhanced safety guidelines and new governmental regulations. Managers can monitor area developments, including media coverage, public opinion, and the likelihood of governmental response. Companies can rate the likelihood of emerging regulations, then anticipate and plan for costly process changes.

Legislation changes usually trigger supply slowdowns while suppliers respond, as when an explosion at explosion at Tianjiayi Chemical Company in China set off a wave of nationwide industrial safety inspection campaigns. Those types of campaigns usually trigger nationwide production halts, plant closures, and industrial zone shutdowns, and being prepared can save time and money.

Once a company fully integrates a risk-assessment system, those insights can inform countless other business decisions. For example, planes can incorporate risk assessment into sourcing and networking planning. They can also access a detailed picture of risk exposure at supplier production facilities or sites identified for capital investments.

CLICK HERE TO DOWNLOAD THE FULL PDF

Safety risk is an inherent part of chemicals procurement, production, and transportation, but new advances in technology can help. Dangerous threats can be envisioned, monitored, and minimized, establishing new levels of safety and security for a volatile industry.

Chemical supply chain management scenario planning

A Category 4 hurricane heads toward the Gulf Coast, where Houston is home to 39% of the waterborne chemicals industry. Roll over each scenario to see the cost of various supply chain disruptions* and the alternate plans based on risk scoring insights. (Note: Estimates for EBITDA losses for a $10B chemicals company derived from Risk, Resilience, and Rebalancing in Global Value Chains, McKinsey, 2020.)

Scenario 1

Local weather forecasts alert Houston five days in advance to potential hurricane impact. Cost: Lost planning days = $750,000

Alternate: Relying on an integrated risk-management platform, ABC Chemicals receives notice 10 days in advance of probable impact.

Scenario 2

Post-hurricane, Houston’s chlorine and ethylene producers declare force majeure, not able to fulfill contracts for two weeks because logistics were stalled by the storm. Late delivery penalties = $2.1M

Alternate: Before impact, ABC Chemicals shifted all production from Houston to Manzanillo, Mexico.

Scenario 3

Gulf port closures and backups delay Chinese shipments of rock salt for four days coming into Houston facilities; damaged Texas oil fields also restrict natural gas production. Price increases; production shortages = $600,000

Alternate: ABC Chemicals anticipates gaps and shifts to rock salt suppliers in India and natural gas in Venezuela shipping to Manzanillo, buying supplies before product shortages or price increases.

Scenario 4

Ethylene and chlorine production return to pre-hurricane levels within one week, but Gulf Coast rail yards are backed up. Spoiled product = $1M

Alternate: ABC Chemicals logistics uses rail to ship finished product from Manzanillo location to main customers in San Diego.

Scenario 5

Post-hurricane logistics disruptions last for two months due to road closures, power outages, and seaport damage. Slow sales = $9M

Alternate: By balancing production between Manzanillo and recovering Houston, ABC Chemicals maintains high production levels while sidestepping procurement and logistics disruptions.