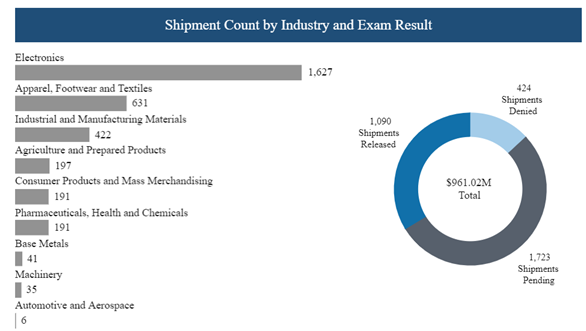

The Uyghur Forced Labor Prevention Act (UFLPA) enforcement continues to disrupt supply chain continuity. In Q1, 2023, 424 shipments were detained for alleged UFLPA violations, while an additional 1,723 remained pending investigation.

At the onset of the Act’s implementation, the renewable energies sector was disproportionately impacted, with polysilicon cells and solar panels used in solar infrastructure as the most detained imports. After nine months of enforcement, the largest impact now falls on consumer electronics, apparel, footwear, textiles, and industrial materials. Customs officials are increasingly seizing products in the agricultural, consumer packaged goods, and pharmaceutical industries.

In the coming months, companies should prepare for UFLPA enforcement to expand to other industries and to further disrupt the sub tiers of global supply networks.

UFLPA enforcement not limited to China

Although the Act focuses on China, many of the inbound shipments targeted for enhanced processing under the UFLPA originate elsewhere in Asia, with concentrations in Malaysia, Vietnam, and Thailand. Though only 13% of total flagged shipments have been denied import in the U.S., an additional 1,723 shipments remain pending for further review. Shipments pending investigation and those detained total 66% of all imports flagged. Once customs agents have worked through the backlog of shipments under review, it is likely that the percentage share of denials will increase substantially.

Figure 1: Electronics and apparel industries top the list of industries disrupted by UFLPA enforcement measures.

UFLPA electronics enforcement linked to Chinese solar subsidiaries

Government data reveals that around 50% of all shipments subjected to UFLPA reviews or enforcement actions involved products from the electronics industry. Of the 1,627 shipments that have been detained, 17 shipments worth over $7 million have been denied with 1,058 shipments worth over $489 million pending review. Only 23 of the electronics shipments reviewed by the CBP originated from China, with most shipments originating from two Southeast Asian nations, Malaysia (927) and Vietnam (664). Malaysia and Vietnam are also the country of origin for all but two of the denied electronics shipments.

U.S. Border and Customs Protection (CBP) has not yet revealed specific details regarding the products contained within the detained electronics shipments. However, it is likely that some of the affected shipments contained solar energy components from Chinese manufacturers, Longi Green Energy Technology Co., Ltd, Trina Solar Co., Ltd, and JinkoSolar Holding Co. All three of these companies have been accused of utilizing forced labor in Xinjiang to manufacture polysilicon. The firms briefly suspended shipments to the U.S. in Q4 2022 after more than 1,000 shipments of solar products were seized under the UFLPA.

Each of the three companies has subsidiaries with significant manufacturing operations in Malaysia and Vietnam. For example, JinkoSolar’s subsidiary in Penang, Malaysia has an output of around 7GW of solar cells and solar panels per year, while Longi Energy also possesses assembly production facilities in the state of Sarawak primarily targeted towards the U.S. market. Trina Solar has a cell and module facility in Vietnam and the company also holds shares in more than 15GW worth of solar component projects in the country.

All three of these companies’ operations in Southeast Asia appear to be focused exclusively on the assembly of solar components, meaning that shipments of polysilicon and other upstream raw materials could have been sourced from China. U.S. Customs is likely halting imports of electronics from Southeast Asian subsidiaries of Chinese solar manufacturers to ensure that the polysilicon found in these shipments is not being sourced from Xinjiang.

Large percentage of denied textile shipments originate in China

Textile products originating in China have a greater likelihood of being denied under the UFLPA compared to those from other parts of the world. On average, 27% of Chinese shipments inspected under the UFLPA have been denied entry into the U.S. compared to just 6% of shipments from other nations. Roughly half of the 310 Chinese shipments that have been denied have contained products from the apparel, footwear, and textiles sector.

Shipments of apparel, footwear, and textiles have the highest denial rates under the UFLPA. 48% of Chinese textile shipments and 41% of global textile shipments have been rejected. Apparel products are being detained under the UFLPA due to the use of cotton sourced from Xinjiang, a major cotton producing region of the world. Nearly 90% of Chinese cotton is allegedly sourced from Xinjiang and approximately 20% of the world’s cotton supply originates from the region. Tracing the origins of cotton used in a textile product is challenging due to the common manufacturing practice of using different types of cotton. Because of this lack of transparency, textile shipments are likely to continue facing high rejection rates under the UFLPA.

UFLPA enforcement outlook

With nine months of customs data to reference, it has emerged that China, though significant for textile shipments, is not the only country of origin for flagged and declined shipments. With increasing shipments being detained from other Asian countries including Malaysia, Vietnam, and Thailand, it is especially important for supply chain managers to understand the vulnerabilities of their extended supplier networks with footprints in these countries.

Expect UFLPA enforcement actions to expand to more industries as we move further into 2023. In the first few months of the year, detainments in the textiles and industrial and manufacturing materials sector have risen. Compared to data from 2022, these sectors have experienced detainment increases of 450%. The widening of a U.S. Senate investigation, beginning March 28, into the automotive industry’s supply chain connections to Xinjiang indicates that industry may soon face heightened scrutiny. The focus has shifted beyond car makers to include Tier-1 suppliers.

On March 18, the CBP deployed an enhancement under the UFLPA that requires all importers to provide postal codes for all Chinese suppliers linked to a specific cargo, intended to help the agency identify potential links between the shipment and the Xinjiang region. Shipments without a postal code will not be accepted in the CBP’s cargo release system. Importers can still use postal codes belonging to third-party sellers, with the exception of textile products which require the code of the actual manufacturer. It is unclear if the addition of a postal code requirement will help increase effectiveness of the UFLPA given that forced labor is more likely to be a problem buried deeply in a company’s sub-tier supply chain.

Watch our UFLPA webinar to learn more about mitigating your risk