Sitting at 34 Celsius / 93 Fahrenheit today but already thinking about winter, gas storage, and geopolitics. The world just hit its hottest week on record.

Gas prices are surging as European energy markets face disruptions, legislation conflicts, and potential supply tightening. However, compared to August 2022 it’s 90% cheaper at Dutch TTF and 75% cheaper for the U.S. So “surge” is relative but, compared to pre-Russian invasion of Ukraine, still a steep 50% higher. If your budgeting has changed, you’re likely celebrating energy “savings” – well, not so fast when compared to pre-invasion price levels.

The upcoming winter season poses supply chain challenges not only for energy dependent industries but any industry that is facing cost impacts and margin squeezes. These challenges require proactive supply chain risk management strategies based on insights and artificial intelligence (AI) that augments the scenarios.

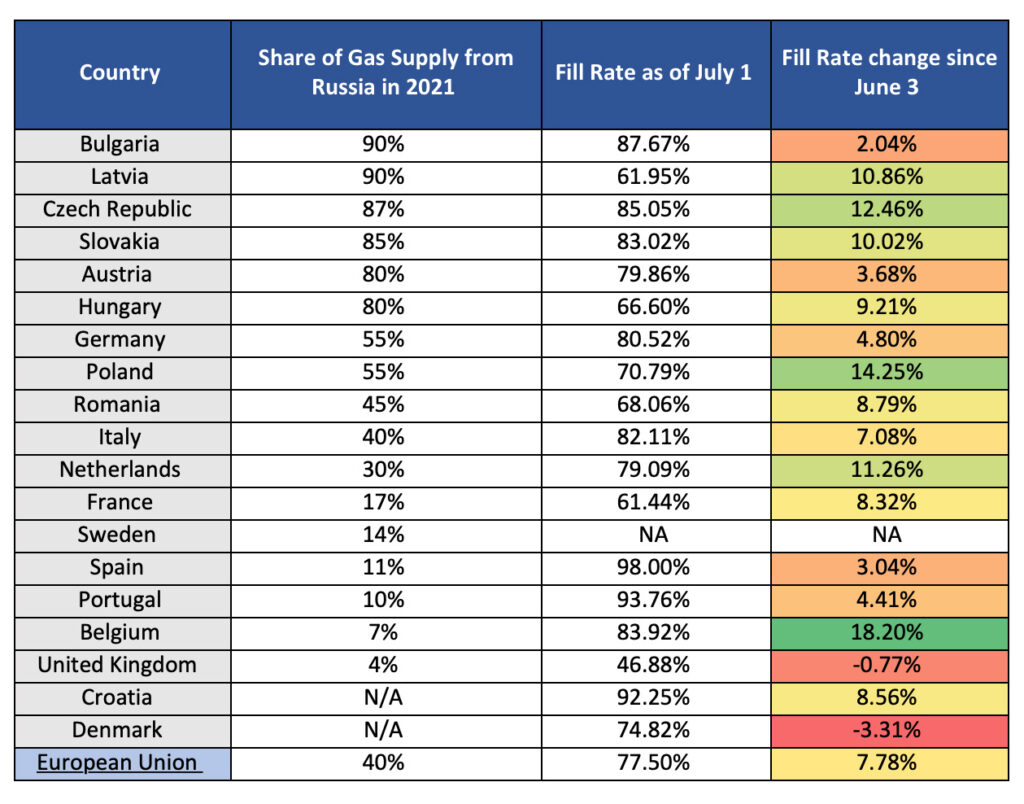

Meanwhile, the EU remains well on track to achieve its 90% storage target for the 2023-24 winter season, with gas storage levels in Germany surpassing the 80% mark as of July 1 – well ahead of the Federal Network Agency’s target of 75% by September 2023. The overall continent’s gas stores rose to 77.5% as of July 1, nearly 20% higher than this time last year. Clearly, gas prices are trending upwards once again.

Status of Gas Storage Capacity in Selected European Countries

Source: Everstream Analytics

Gas prices on the rise: Gas prices on the Dutch TTF natural gas price index rose over the month of June due to outages at Norwegian gas facilities, causing significant disruptions in the European energy markets. The TTF neutral gas price index surged by 30%, reaching a high of €41.70/MWh, which directly impacts business profitability and increases operational costs for industries reliant on gas.

Yes, prices have significantly dropped but from an extreme high caused by a geopolitical impact that could not establish a new norm. Compared to 2021, a 50% increase still needs absorption and without n-tier visibility companies don’t know the financial situation of the companies in their supplier network..

Production outages and political instability: The stability of gas supply in Europe was further compromised by a series of production outages at three Norwegian gas facilities operated by Equinor ASA and AS Norske Shell. These outages resulted in a decrease in the country’s energy exports to Europe by approximately 1.4 bcm.

While there were improvements in gas exports from Norway as some facilities resumed production, maintenance work at Norske Shell’s Nyhamna gas processing plant has been extended until mid-July, continuing to impact gas flows. The interdependence shows the fragility of the supply network, and every event has an immediate market response. Companies that work mainly in the “now” will likely go through turbulent times this fall and winter. In addition to production outages, political instability added to the uncertainties in European gas supply. The failed rebellion by the Wagner Group against Russian authorities during the weekend of June 24 unsettled energy markets, leading to a 13% increase in front-month gas prices on June 26. This highlights how geopolitical events can quickly disrupt the energy landscape, affecting pricing and availability.

It’s critical to understand the energy need and current supply situation in lower tiers, and incentivize alignment with the overall energy transformation to decouple from fragile concentrations that are both volatile in price and supply availability.

Reforms in power markets stalled: Efforts to reform the power markets in Europe to prevent a repeat of last year’s energy price spike have faced significant challenges. Disagreements over subsidies for renewable energy sources and nuclear plant subsidies have stalled negotiations and hindered the revamp of the electricity market. These disagreements create vulnerabilities in the power generation and supply system, leaving it susceptible to price fluctuations and potentially compromising the stability of the energy supply.

There are similar movements in the U.S. energy market and globally, whereas not every country and trade bloc are aligned on investments into renewable energy. As one mitigation factor, there is significant investment into nuclear power generation happening outside the EU. Aligning a business’ energy strategy to the value chain is critical, understanding power sources, the energy and supply chain networks and fragilities are key as companies can no longer operate in isolation with only their Tier-1 suppliers in sight. This is as much strategic risk management as it is operational risk management.

Potential impact of rising temperatures: Rising temperatures in July pose additional challenges to Europe’s energy situation. As temperatures increase, cooling demand rises, putting additional strain on gas supplies. Cooling relies on electricity and, with Germany as one example, gas power plants were meant to be the contingency with nuclear as the core energy source. This now has changed with the nuclear power plants being taken off the grid.

In addition, warmer weather may reduce hydropower output due to drought concerns, further impacting the energy mix. This combination of increased cooling demand and reduced hydropower availability adds pressure to gas supplies and overall energy availability, affecting businesses and consumers alike.

As energy problems heat up, a holistic strategic risk management considering the interdependencies of key risk indicators is critical. So is seeing the full picture that will enable companies to decide actions on value-at-risk and not siloed decisions that may be receptive to bias and perceived importance and urgency.

Effective risk management is crucial for companies operating globally, and not only in Europe, to navigate the energy crisis. Prioritizing technology-driven risk management solutions can help businesses be proactive, prevent disruptions, and maintain value-driven operations. Tools like Everstream Reveal and Everstream Discover provide real-time insights to stay informed about political and economic developments and identify vulnerable suppliers, enabling proactive measures to mitigate risks.

Download our new report to learn how AI is revolutionizing supply chain visibility