Grains and wheat

Following Russia’s return to the Black Sea Grain Initiative and the agreement renewal on November 19 for another 120 days, grains and other food exports recommenced from the Ukrainian ports of Chornomorsk, Odesa, and Pivdennyi (Yuzhnyi), leading to a decline in global wheat prices in November. As of December 11, total grain shipments have hit approximately 13.7 million metric tons. Nevertheless, there is still the possibility that grain shipments will be delayed by Russia’s continued drone strikes on energy infrastructure, which on December 11 caused the Odesa port to cease operations.

In addition, while delays on the Lower Mississippi River have improved in December due to more rainfall, low water levels on the Upper Mississippi River continue to affect transportation flows since laden barges must remain light. Consequentially, bulk goods may not arrive on schedule. Around 60% of corn and soybeans meant for export from Midwestern U.S. states travel the river.

Meanwhile, recent flood occurrences in Australia, the world’s second-largest wheat exporter, created severe crop destruction. An anticipated drought will decrease wheat availability in Argentina by about 40%. Both scenarios may impact global wheat supply in the first half of 2023.

Rice

Due to strong buying interest and the appreciation of U.S. currency for some Asian suppliers, rice prices increased by 2.3% globally in November. Prices could continue to increase as long as India, a major rice supplier, maintains the export levies it imposed earlier this year. Drought conditions in eastern India have also contributed to a decrease in its rice output.

Indonesia, another major producer, imported 200,000 tons of rice to maintain price stability and restock domestic volumes. The country also intends to import rice from Thailand, Pakistan, and Myanmar to counteract missed harvests anticipated for early 2023.

Palm oil

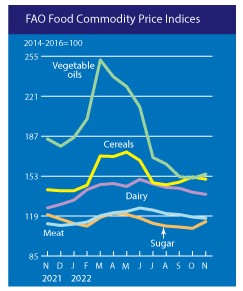

Due to competitive pricing and production woes amid heavy rainfall in several major Southeast Asian growing regions, demand for palm oil imports has increased, leading to higher global market prices for palm oil and its byproducts. Indonesia announced the intention to increase the reference price for crude palm oil by about 6% for the latter half of December. Industry experts forecast that Malaysian palm oil may trade at an increased price range until the end of May 2023 as stockpiles run low at the top two producer countries.

Sugar

According to the FAO Sugar Price Index, the global value of sugar increased 5.2% from October to November, the first increase recorded following drops for the six prior consecutive months. The main reasons for this were limited global sugar supplies brought on by harvest delays in important producing countries as well as India’s plans to lower the sugar export quota. The fuel tax case settlement in Brazil may be another key factor, as improved tax status could aid the market situation for ethanol and lower the pressure on global sugar prices.