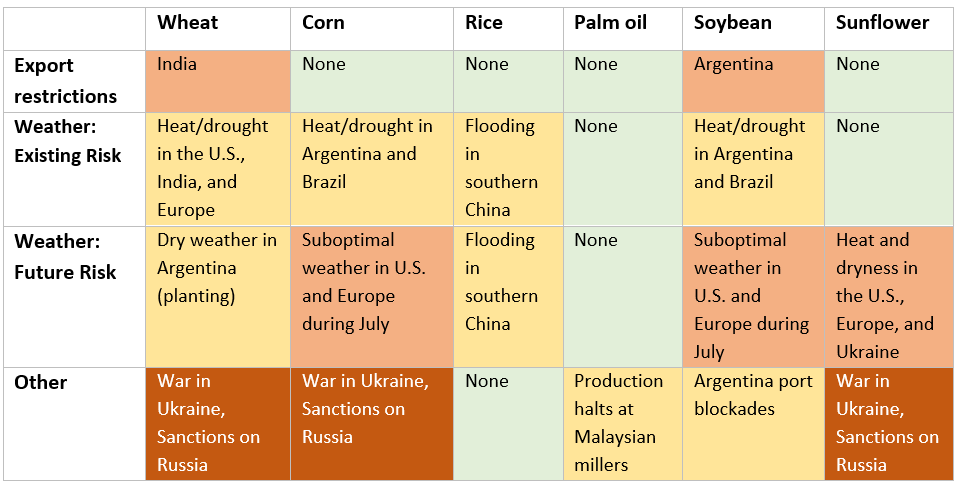

The global supply of grains, namely wheat, and corn, has become vulnerable for similar reasons. The war in Ukraine has stranded around 25 million tons of grains from last year’s harvest in silos across Ukraine and at Baltic ports. This, in parallel with sanctions on Russia also impacting international distribution, has cut off roughly one-third of global supply. EU and U.S. grain production forecasts expect a 1.4% and 8% decrease from 2021 volumes, respectively.

Wheat

Grain prices have seen a marked drop over the past weeks, having fallen back to or below where they stood at the onset of Russia’s invasion of Ukraine. The easing of the wheat supply crisis is partly a result of a recent rush of Russian wheat shipments through Black Sea ports. The affected terminals handle both grain and sunflower oil.

Corn and Soybean

Corn and soybean exports in Argentina have faced disruption from a nationwide trucker strike that began on June 22. This strike action nearly brought operations to a standstill at the Port of Rosario, a key grain port that serves as the gateway for approximately 80% of the country’s agricultural exports. The nationwide strike action ended on June 30, with grain ports largely returning to normal shortly thereafter.

Rice

Concerns over a potential export ban on rice by the Indian government remain, though no decision has been made yet. Due to India’s recent regulatory changes with wheat and sugar, rice traders have begun preparing for the worst. As rice is likely to take on a more prominent role as an animal feed alternative to wheat and corn, price surges will remain a concern moving forward. Other rice production disruptions occurred in recent weeks from flooding events in southern China.

Sunflower oil

To boost its exports of sunflower oil, Russia announced on July 2 that it had sharply reduced its sunflower oil export tax. Per ton, the sunflower oil export tax for July has been set at 8,408.7 roubles ($163.3; €124.4), down from $560.1 per ton previously, when the tax was set in U.S. dollars.

Palm oil

Indonesia, the world’s largest producer and exporter of palm oil, has raised its palm oil export quotas amid high domestic palm oil inventories. The move, effective July 1, allows companies that have sold palm oil in the local market to export seven times the amount of their domestic sales, an increase from what had previously been five times the amount. However, shipments have reportedly been hampered by issues finding available ships for transportation.

In Malaysia, the world’s second largest producer and exporter of palm oil, output was disrupted at the end of June as several palm oil millers halted production for multiple days due to a recent plunge in palm oil prices.

Outlook and recommendations: Key developments to monitor this summer

As political and economic instability remain widespread and extreme weather patterns are expected to continue, further supply limitations could surface this year. Commodities most at risk of further disruption are grains due to extreme weather conditions in India and Brazil and oilseeds due to mounting insecurity in Turkey and Moldova. As was the recent case in Sri Lanka, further disruptions to the availability of critical commodities could lead to outbreaks of protests and civil unrest around the world.

Companies are encouraged to increase visibility into their reliance on sourcing key agricultural commodities from affected countries and analyze whether any of their critical suppliers are located within countries under trade restriction, assessing the impact of supplier disruptions on their overall operations. Predictive analytics can forecast sourcing implications from extreme climate and weather patterns on agricultural commodities.

Learn how real-time intelligence can turn your supply chain into a competitive advantage.