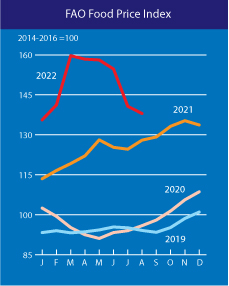

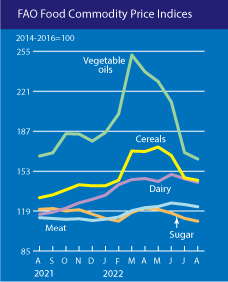

In August, the FAO Food Price Index fell for a fifth month in a row, now standing at a lower level than before the Russian invasion. All five sub-indices of the index, including cereals, vegetable oil, dairy, meat, and sugar, continued to drop in August. Monthly percentage declines compared to July ranged from 1.4% for cereals to 3.3% for vegetable oils. The continued fall in prices is attributed to a mix of reasons, including better harvest outlooks for cereals in Russia, the U.S. and Canada, and stabilizing exports from Ukraine’s ports further easing cereal and vegetable oil prices. However, concerns about shipments from Ukraine remain. Overall, food prices remain elevated, with the UN’s Food Price Index standing 7.9% above its value a year ago.

Key commodities to watch through summer

Figures 1 and 2: UN’s Food and Agriculture Organization (FAO)’s food price index (FFPI), monthly release date of September 2, 2022 (source: FAO).

Grains and oilseeds

Grain and oilseed exports from Ukraine have risen to approximately 4.5 million tons in the month of August, showing a significant increase from July’s 3 million tons. The breakdown of August’s shipping volume in terms of transportation modes reveals that approximately 3 million tons were shipped via the Danube River and through Black Sea ports, 1 million tons via rail, and 600,000 tons via road transportation.

Notably, Russian wheat exports have fallen by 22% to 6.3 million tons over the months of July and August compared to last year, adding to global supply pressures. Wheat exports are expected to slightly speed up reaching 4 million tons in September.

Besides increasing product volumes leaving Black Sea ports, grain exports shipped via Ukraine’s river ports also continue to rise, with now more of the product shipped than at any point since the Russian invasion began. In total, more than 4 million tons of grain have been shipped out through the country’s river ports over the past six months. Agricultural exports could increase to reach 5 million tons in September, according to estimates by Ukraine’s farm ministry

Despite this positive development, it is expected that most of this cargo is bound for use as animal feed and will not yet contribute to the alleviation of food shortages, the worst of which are hitting developing countries. In any case, this gradual export resumption signals a move toward trade normalization which is expected to increase global grain supply and further stabilize prices.

The resumption of agricultural exports from Ukraine has also included cargoes of sunflower meal and oil. However, despite these incremental improvements in Ukraine’s shipments, Ukraine’s sunflower meal exports are still forecast to decline from 66% to 40% of the global share. Similarly, its sunflower oil exports are forecast to plunge from 50% to 35% of the global share.

In Asia, the availability of wheat flour has been curbed by the Indian government imposing export restrictions in late August. The move comes as a reaction to a heatwave that reduced domestic wheat output last growing season and increased prices for the product. In neighboring Pakistan, new winter wheat crop planting is threatened in the coming months due to major flooding, affecting approximately 2 million acres of crops. Approximately 725,000 tons of wheat stocks, ready for exports, have been washed away in the country, which is Asia’s third-largest wheat producer.

The next key issue that can impact global food production is the start of the summer growing season in the Southern Hemisphere. Planting of summer crops will start in October/November. The focus of attention will be South America (Brazil, Argentina, Paraguay, and Uruguay), which is overwhelmingly the key growing area in the Southern Hemisphere.

Palm oil

To boost palm oil exports and reduce domestic oversupply, the Indonesian government has extended its zero-levy policy until October 31. In Malaysia, palm oil production continues to suffer from an acute labor shortage that producers are increasingly trying to address by using automation technology to support the application of fertilizers as well as harvesting processes.

Rice

The Indian government is considering imposing export curbs on 100% broken rice to ensure domestic supplies and lower inflation. Current flooding events in Pakistan, among the top 10 rice-producing countries globally, have damaged swathes of farmland including rice crops in the country, adding to concerns over rice price developments. Rice production could also decrease in four of the world’s five top producers for reasons including monsoon rain deficits in northern India, the recent heatwave in southern China, floods in Bangladesh, and grain quality issues in Vietnam.

Sugar

The Indian government is expected to soon approve sugar exports for the coming 2022/23 season beginning October 1. Even before the policy announcement, traders already signed deals to export 300,000 tons of raw sugar in the 2022/23 season, anticipating that global prices could drop once India announces its 2022/23 marketing year quota. In the 2021/22 marketing year, the government-imposed restrictions on sugar exports for the first time in six years, capping overseas sales at 11.2 million tons.

Everstream clients are receiving detailed information about this risk.

Contact us to learn how we can give you a complete view of the risks affecting your end-to-end supply chain and what you can do to mitigate them.